Your personalised solution to navigate the property market

Achieve your property ownership goals, with a personalised strategy from ScaleApp

Pre-Register

Your personalised solution to navigate the property market

Achieve your property ownership goals, with a personalised strategy from ScaleApp

Pre-Register

How does it work?

4 steps to scale your portfolio

4 steps to scale your

portfolio

4 steps to scale your property portfolio

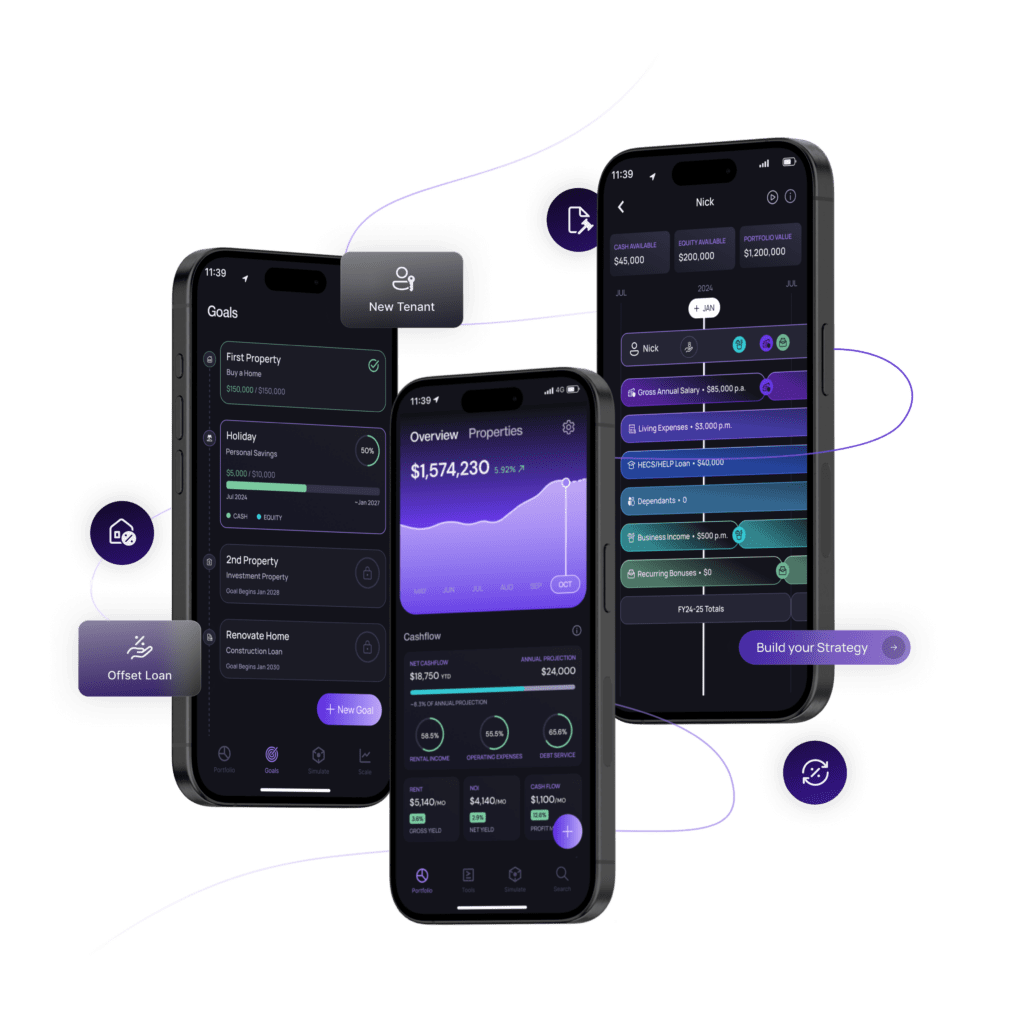

Step 1

Define your property goals

We help you understand where you’re at, so you can focus on where you want to go.

- Personal & property savings goals

- Dynamic forecasts

- Acquisition cost & stamp duty calculator

Step 2

Unlock personalised property insights

Make informed decisions with actionable data tailored to you

- Estimate acquisition and holding costs

- Live price and rental estimates

- Compare properties in seconds

Step 3

Create & compare strategies

Simulate your strategy before executing it to effectively mitigate risk & maximise returns

- Import real properties directly into your strategy

- Plan key personal & portfolio events and milestones

- Annual cashflow summaries & forecasts

Step 4

Track your progress

We’re bringing stock-like visibility to your property portfolio

- Live portfolio valuation powered by PropTrack

- Tax savings, cashflows & advanced metrics

- Intuitive lessons & insights

Step into the property market with confidence

More than just a budgeting tool

Crush your personal & property goals

Understanding your current financial position is the first step to improving it. Set your goals and watch them move closer as your optimise your strategy.

Simulate your strategy

Visualise your roadmap to ownership

Zoom out to plan your biggest goals, then zoom in to solve each specific step. Break down your property goals & put one foot in front of the other without losing track of the big picture.

Search & compare

Analyse real properties in real-time

Access Australia’s largest property database to instantly assess whether a property is right for you.

Improve your financial literacy

Grow alongside your property portfolio

Develop the skills you need to build and sustain wealth through property with intuitive insights at every stage of your journey.

Find your first home formula

Don’t recognise these terms? Not for long. ScaleApp doesn’t just give you the data to succeed, we make sure you can understand it too.

Capital Works Depreciation

PP&E Depreciation

Low Value Asset Pooling

Land Tax

CGT Liability

6-Year Absence Rule

Refinance Simulator

Construction Loans

Voluntary Repayments

Offset Accounts

Negative Gearing

Single Room Rentals

Joint Ownership

Scenario Analysis

Educational Features

PAYG Tax & Medicare Levy

HECS/HELP Repayments

Income Tax Return

Refinance SImulator

Construction Loans

Voluntary Repayments

Offset Accounts

Negative Gearing Forecasts

Single Room Rentals

Sign up today to kickstart your property and financial literacy journey!

See what our users are saying

Being able to analyse real properties & incorporate them into a strategy alongside my personal cashflows on the move is really powerful.

Johnny

Early Access

The long-term view of the simulator timeline & ability to compare scenarios made it easy to figure out where I should live when I finish uni while still allowing me to save.

Claudia

Early Access

I thought it wasn’t even worth trying to save for a property.

ScaleApp has renewed my belief that I can buy a home by giving me a plan that I can understand.

Vincent

Early Access

With kids on the way we needed a simple way to plan our financial future.

ScaleApp is exactly that!

Jamie & Mary

Early Access

Manages to take the vast puzzle of the property market and spits out real useable information, instantly.

Like having a property professional in your pocket.

Max

Early Access

ScaleApp has helped me start planning and saving for my first investment property. In a market that is tricky to navigate at the best of times, Scale has made it seem far more achievable.

Ed

Early Access

I was surprised that it helped show the impact of my HECS loan on my property savings plan.

I wouldn’t know how to incorporate that into my existing budget but it made a huge difference!

Amber

Early Access

The simulator makes it extremely easy to see the impact of my spending habits on my ability to buy my first property.

Liv

Early Access

Nick Melrose

Founder

The housing affordability crisis has become the generation-defining issue faced by young Aussies who, by large, are watching their endeavours towards home ownership being outpaced by the cost of living & deteriorating lending conditions. ScaleApp offers a versatile tool to help users navigate an increasingly fluid property market with low-cost access to the insights required to plan for ownership, mitigate risk & succeed in their property goals.

What's on your mind?

- How does my HECS affect my ability to buy property?

- Should I buy a home or investment property first?

- How will changing interest rates affect my savings plan?

- How do I make sure I don’t overspend on my first property?

- When can I buy my first property? How long will it take me to save?

- How do I optimise my portfolio once I’ve purchased by first property?

- What’s the benefit of rentvesting?

Being able to analyse real properties & incorporate them into a strategy alongside my personal cashflows on the move is really powerful.

Johnny

Early Access

The long-term view of the simulator timeline & ability to compare scenarios made it easy to figure out where I should live when I finish uni while still allowing me to save.

Claudia

Early Access

I thought it wasn’t even worth trying to save for a property.

ScaleApp has renewed my belief that I can buy a home by giving me a plan that I can understand.

Vincent

Early Access

With kids on the way we needed a simple way to plan our financial future.

ScaleApp is exactly that!

Jamie & Mary

Early Access

Manages to take the vast puzzle of the property market and spits out real useable information, instantly.

Like having a property professional in your pocket.

Max

Early Access

ScaleApp has helped me start planning and saving for my first investment property. In a market that is tricky to navigate at the best of times, Scale has made it seem far more achievable.

Ed

Early Access

I was surprised that it helped show the impact of my HECS loan on my property savings plan.

I wouldn’t know how to incorporate that into my existing budget but it made a huge difference!

Amber

Early Access

The simulator makes it extremely easy to see the impact of my spending habits on my ability to buy my first property.

Liv

Early Access

Nick Melrose

Founder

The housing affordability crisis has become the generation-defining issue faced by young Aussies who, by large, are watching their endeavours towards home ownership being outpaced by the cost of living & deteriorating lending conditions. ScaleApp offers a versatile tool to help users navigate an increasingly fluid property market with low-cost access to the insights required to plan for ownership, mitigate risk & succeed in their property goals.

What's on your mind?

- How does my HECS affect my ability to buy property?

- Should I buy a home or investment property first?

- How will changing interest rates affect my savings plan?

- How do I make sure I don’t overspend on my first property?

- When can I buy my first property? How long will it take me to save?

- How do I optimise my portfolio once I’ve purchased by first property?

- What’s the benefit of rentvesting vs. buying a home?

Frequently asked questions

What is the Ownership Simulator and how does it work?

The Ownership Simulator is an interactive timeline that visualises your path to buying a home—incorporating income, savings targets, acquisition costs, and HECS/HELP loans—so you can experiment with lifestyle & savings scenarios like rentvesting, delaying purchases, or adjusting location preferences in real time.

How does ScaleApp combine budgeting inputs with live property data?

ScaleApp merges your personal budgeting details (income, expenses, savings, debt) with real-time listings from PropTrack, letting you compare affordability projections for actual homes alongside your anonymised financial profile.

Can I include my HECS/HELP debt in my home‑buying projections?

Yes. You simply add your HECS/HELP balance into the simulator, and your deposit timeline and affordability estimates automatically adjust to reflect that obligation.

How current is the property data in ScaleApp?

ScaleApp’s Real-Time Property Analysis sources live market feeds from PropTrack (the data arm of realestate.com.au), ensuring your comparisons and forecasts use up-to-the-minute listing and sales information.

How is my personal data protected and anonymised on ScaleApp?

All inputs are anonymised at the account level and stored with industry-standard encryption. We never share your personal data, individual strategies or property data with any third parties without your consent.

How does ScaleApp help improve visibility over your home?

Once you add your home to your portfolio Dashboard, ScaleApp becomes your property portfolio cockpit—tracking live valuations, estimated tax outcomes, financing costs, and long-term performance metrics alongside useful educational insights scattered throughout.

Can I simulate the impact of renovations or refinancing?

Yes. Using the Scenario Comparison Tool, you can model inputs like renovation budgets or new loan terms to see informational projections of how those changes might affect your home’s financial outlook.

What performance metrics does ScaleApp show for my property?

ScaleApp surfaces cashflow estimates, live market valuations, tax implications, and return-on-equity projections—offering a consolidated view of your home’s key indicators.

How frequently are my valuations updated?

ScaleApp pulls on PropTrack’s industry-leading data to give you a live valuation estimate of your property on the 1st of each month.

How is my personal data protected and anonymised on ScaleApp?

All homeowner inputs are anonymised and secured with encryption. We never share your personal data, individual strategies or property data with any third parties without your consent.

Can I analyse multiple investment properties simultaneously?

Absolutely. You can add several properties to your profile and view each one’s cashflow projections, live valuations, tax estimates, and overall performance in your portfolio Dashboard.

How does the Simulator support investment analysis?

By adjusting variables—such as interest rates, rental yields, or maintenance costs—you generate side-by-side forecasts that illustrate potential returns and risks across different investment scenarios.

What data sources power ScaleApp’s investment estimates?

ScaleApp relies on real-time property data from PropTrack (REA Group’s data arm) combined with our audited financial model—ensuring that price and valuation estimates are driven by live data, while any hypothetical market changes (e.g. rate shifts) are able to be explored through user-initiated simulations.

What financial factors does ScaleApp include in its investment analyses?

ScaleApp’s model covers basic cashflow and growth projections, loan terms, offset accounts, construction loans, student debt, and personal income tax—applying all these factors to each property scenario for a comprehensive view.

How is my personal data protected and anonymised on ScaleApp?

All investor inputs are anonymised and secured with encryption. We never share your personal data, individual strategies or property data with any third parties without your consen